The property market can be a daunting place for a lot of first time buyers, especially with the lack of affordable housing it can often seem that the property ladder and owning a house is beyond reach.

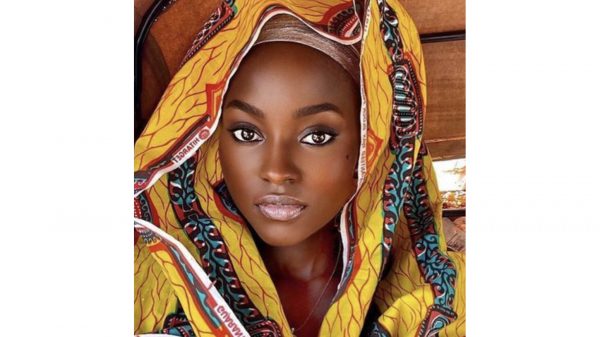

There are of course some who manage to buck that trend – one being Jade Vanriel, a 25-year-old Law graduate, YouTuber and an accomplished homeowner. Unlike many of the stories of young people bouncing back home for years on end after university, she was able to successfully purchase her first home at the age of 23 – and with no cash help from her family. The secret to Jade’s journey to home ownership lies in her long-held determination to save – by skipping as many treats as possible, and saying no to partying, she proved that with scrimping and sacrifice, it is indeed possible to be a young homeowner.

Despite not initially saving for a house, Jade, like many of us, was frequently told by her parents to save money. ‘My parents were always telling me to save and I actually listened.’ she says, acknowledging that the spirit of saving was drilled into her from a young age, whether it was pocket money, or earnings from summer and weekend jobs. This routine remarkably followed her throughout college and then university.

In her second year of study, she decided that she wasn’t going to become a lawyer after all, as by that time she had ‘fallen out of love with law’. While she continued her degree, she decided to start investing all her energy and money into saving for a mortgage, rather that expecting to move back home permanently. A new sense of independence drove Jade’s decision; as an only child and already having moved away to study in a new city, the thought of moving back home was a non-starter: ‘ I didn’t want to go back home, I got used to being independent, I felt too mature and had outgrown living with my mum, so I had to figure out how I was going to do that.’

Jade was able to prepare to become a homeowner by moving in with her aunt – while still paying rent. She was still able to save whilst paying rent thanks to her job at a Legal Publishing company. Understandably, this is not a privilege that everyone looking for individual living shares; low wages, location, pre-allocated savings and family setup are factors that can greatly hinder the amount that someone can save, or whether they’re able to pay a reduced amount of rent. However, if there’s any way that you can put money aside, it’s never too late to make a small start.

Although it wasn’t easy by any means, Jade stands by her belief that if you stick to saving all you possibly can, by restricting yourself to essentials until your goal is met, getting a deposit for a home together is not out of reach. So when asked the percentage of her wage that she saved each month, she didn’t have a set number – it was simply as much as possible: ‘if you’re adamant it’s something you want to do, you shouldn’t put a percentage against it.’ Everything that wasn’t food or travel went towards the deposit fund – and this discipline eventually led her to ‘over save’, so when she moved into her Essex property in 2017, she was able to furnish and start renovations on her flat.

Despite achieving a huge accomplishment, it didn’t come without some negatives, as Jade did face doubts from family who doubted her capabilities to friends who drifted because of her decision to save rather than go out and spend.

‘I lost loads of friends, so people need to be prepared for that as well,’ she admits. ‘Especially if you’re young; your’e expected to be having fun, spending and out all the time, but when your’e constantly saying no because you have to save, people can’t relate to that … they don’t understand it. It’s funny now, two years later, some of these people are coming to me asking for advice.’

JADE’S TOP TIPS

Look around: Jade highlights the importance of looking at different properties and not settling for the first one you see. ‘I took my boyfriend to see one because I was so impressed with it. What were we thinking? That property was half the size of my home now, the same price, and not in as good of an area. I was so clueless; both of us going in there thinking it was amazing. I remember showing it to my dad and him going no way, there is better, I even cried – but now I’m like thank you so much!’

Research: Whether its about the property ladder, your desired location or what schemes the Government offer, looking for the advice is your best friend: ‘ Researching what it’s going to cost you to live in that home, knowing what council tax bracket you are, so you know how much money is going to come out every month, and what your commute to work would be like are all things you need to look at before you put an offer on a property, so you know you can afford it.’

Over save: One of the major lessons Jade learnt on her property journey was to have more in the bank than the exact deposit amount: ‘Over save, if you can – I’m really happy I did. For example: if you’e looking at a deposit for £10,000, don’t just save £10,000 save £15,000 or more because you’re going to have many different fees, things that come out of the woodwork when you first move in.

Subscribe to Jade Vanriel’s YouTube channel here