A trip to the hair shop is often an essential part of many black women’s life experience, across the diaspora. However, when it comes to who’s selling, it is rarely the same people who are buying the products behind the tills. Wedaeli Chibelushi explores what the black hair industry looks like around the world.

In 2015, Sandra Brown-Pinnock made waves by opening black hair store xSandys. Though Brown-Pinnock launched xSandys online, her offering soon evolved into physical shops in Lewisham and Peckham. (The Peckham branch closed its doors in February 2018.) Her entrepreneurship is admirable, sure. But why does a black woman opening a black hair store warrant so much attention?

To date, Brown-Pinnock remains the only black owner of a black hair store in South London. She is outspoken about being a minority in the UK black hair care industry, which happens to mostly represented by South Asian men.

But is the UK industry an anomaly, or is the ownership of black hair product stores by non-black owners part of a wider trend? And if so: does it even matter? I explored the UK and three other countries with a large black diaspora to find out.

UK

A 2014 study found that in the UK, black women account for 80 percent of total hair care sales. It’s a huge figure, but one that comes as no surprise to black hair and beauty supply store owner Desire Bare. From his store in Norwich, he explains: ‘I saw that in London and Bedford there were black hair shops, but there were few here.’

He opened his shop, ADOM Hair and Cosmetics, to cater to this huge demand. Since its opening in May 2018, has Desire felt like Brown-Pinnock – a racial minority in the industry? He acknowledges the prevalence of South Asian competitors, and believes their dominance in the industry results from their being ‘more united’ than black businesspeople. To Desire, South Asian stores buying wholesale product together to undercut retail prices is ‘fair competition.’

However, these vendors haven’t always been the ones to beat. In the 1960s, Jamaican-owned black hair care chain Dyke & Dryden became Britain’s first black-owned multi-million pound business. It was only in the Nineties that Dyke & Dryden yielded to competitor pressure, and sold to American company SoftSheen Carson. Many believe that the demise of Dyke & Dryden signalled the lapse of black ownership in the hair industry. I ask Desire whether by shopping in black-owned stores, black people could reintroduce their stake in the industry, to which he responded by explaining that people simply shop where is convenient and affordable for them: ‘Black people shouldn’t feel they have to be loyal to black-owned places.’

Local pharmacist, and consumer of black hair products Anita Ncube disagrees: ‘I prefer to buy from black owners because they already have that understanding of my hair and don’t need to learn it,’ she reasons.

France

It may be laden with politics, but the UK black hair care industry provided serious inspiration for French black businesswoman Anna-Marie Mendy. While holidaying in London, Anna noticed the quality of black hair stores was superior back home. In 2011, she and husband Frédéric sought to bring the French market up to standard. They launched Colorful Black, an ambitious hair line.

Although Mendy notes a difference between the British and French industries, there is a common denominator: Black French people (who are a substantially large community) often recount that when they visit a black hair store, there’s a non-black person on the till.

‘Most stores in IÎe-de-France [a Parisian region] are owned by Arab and Pakistani people, rarely Africans,’ Black French student Heloise Borrett* states.

‘It is something historical,’ Mendy says. ‘They were the first to do business with American hair care companies.’ Before Colorful Black, Anna-Marie Mendy found the majority non-black market as to be lacking in quality and ‘selling without advice’ on black hair.

Does mean that non-black owned stores are inherently limited? Mendy is undecided: ‘It is too easy to reduce this to an origin. I am a black woman while my husband and business partner is white. Even though he did not know anything about afro hair care, that’s something he has learnt.’ Similarly, though she feels that non-black proprietors naturally lack experience of black hair, student Borrett ultimately feels that ownership is only ‘a little important’ when it comes to the industry at large.

US

Across the Atlantic, the ownership issue is just as complicated. Black hair care is a statistically lucrative market; according to market research firm Mintel, the 2015 sales of the overall black haircare market were an estimated $2.7 billion. South Korean businesses control approximately 60-80 per cent of the market, while African-Americans make up 14 per cent of the US.

‘Among my peers, we just kind of assume that is because they have access to the products,’ Dr Jessica Clemons, a New York psychiatrist tells me. Dr Clemons and her friends have a point; in her novel The Sun Is Also A Star, author Nicola Yoon explains that in the 1960s, South Korean wigs became popular in the black community. The South Korean government banned the export of raw hair, meaning wigs made from South Korean hair could only be made in South Korea. During this time, the US government banned the import of Chinese hair. ‘These two actions effectively solidified the dominance of South Korea in the wig market,’ Yoon concludes. ‘The wig business naturally evolved to the general hair care business.’

Clemons thinks this monopoly psychologically impacts the black community. She adds: ‘We can’t be what we can’t see. We’re not really able to take stake or create ownership in the arena that really was created for us.’

Canada

Although Canada’s black hair care market is more emerging, it mirrors the ownership trends seen in the USA. Kerlande Mibel, President of the International Black Economic Forum, confirms: ‘Most black hair product stores are non-black – at least, not the major ones.’

Canada’s black population is five times greater than its Korean one, yet it’s well known that Koreans dominate the country’s black hair care market. To some Black Canadians, it’s important to support the few existing black-owned stores as a way of retaining the culture.

‘This is how we continue our traditions and pay it forward,’ Ryerson University assistant professor Cheryl Thompson explains. ‘In my experience, white-owned or Korean-owned stores don’t care about our culture or history. They just see money and that’s just not something I support today in my life.’

Mibel and the International Black Economic Forum also encourage black customers to buy from black-owned stores by outlining the potential benefits. ‘First, the impact will be one of wealth creation. It’s a start to bridge the economic disparity. Also, it means job creation, which will benefit our communities first,’ she adds.

Mibel’s comments emphasise the fact that where there is a black diaspora, there is a complicated hair care industry. Whether black people are impassioned or indifferent about it, there’s no denying that across these western countries, a significant part of black culture is bought, then sold to us for a profit.

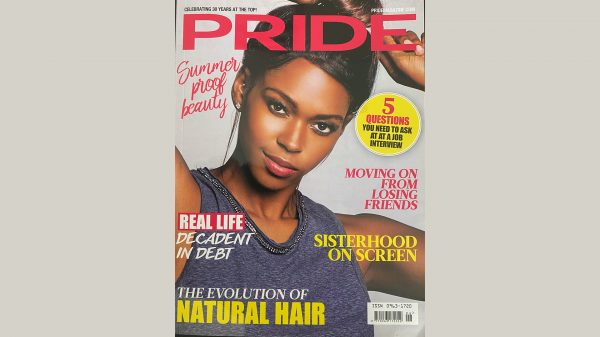

However, exploring the diaspora also reveals change. Mendy (France), Thompson (Canada) and Clemons (USA) talk of the growing popularity of natural hair among black people. There has been a rise in black-owned businesses, like Curls Dynasty (US) and Natural Health Harmony (UK), that disrupt established supply chains by selling their natural hair products to black-owned stores. ‘Black people are trying to be a part of the process instead of just the consumer,’ Clemons says.

On the other hand, black-owned brands like Snob Life have gained a market share through innovative social media campaigns. At aged 24, Snob Life owner Ming Lee set up her hair extensions business with only $500. She drummed up almost 1million followers on Instagram – numbers that translated into sales, expansion and press attention.

If the natural hair movement and social media are giving black people more control of the industry, then it’s only a matter of time before we see whether wealth and jobs increase in the black communities. Does who owns black product stores really matter? I guess we’ll have to wait and see…

*Name changed due to a request for anonymity